Key Changes to Employment Law in 2022

Jane Baalam

April 4, 2022

Key Changes to Employment Law in 2022

As we reach the end of the current tax year, we thought it would be useful to reiterate what’s happening in 2022.

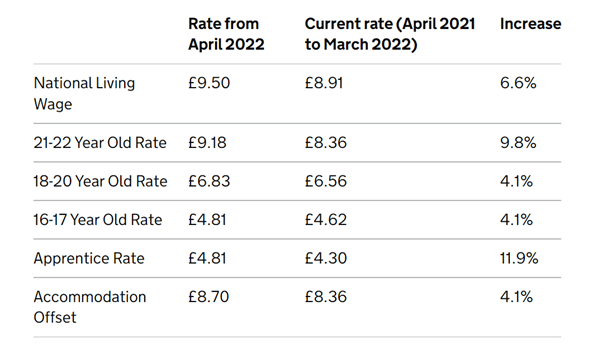

Minimum Wage Increase

National Living Wage and National Minimum Wage will both see increases from April 1st 2022.

The National Insurance Threshold Rises

Information taken from Prepare for the Health and Social Care Levy - GOV.UK (www.gov.uk)

For tax year 6 April 2022 to 5 April 2023

Employer Class 1, employee Class 1, Class 1A, Class 1B and Class 4 National Insurance contributions will increase, for one year, by 1.25 percentage points.

From 6 April 2023

The National Insurance contribution rates will go back down to 2021 to 2022 levels, and the levy will become a separate new tax of 1.25%.

How the levy will affect you:

Between 6 April 2022 and 5 April 2023

If you are an employer, employee or self-employed (and below the State Pension age), you will pay the 1.25 percentage points increase in National Insurance contributions.

From 6 April 2023

The separate levy of 1.25% will apply to the same amounts for the following classes of National Insurance contributions:

- Class 1 that are above the primary and secondary thresholds

- Class 1A and Class 1B for employers

- Class 4 for the self-employed

All existing National Insurance contribution reliefs will apply to the separate levy for:

- employees under the age of 21

- apprentices under the age of 25

- qualifying Freeport employees

- those eligible for the Employment Allowance

- armed forces veterans

HMRC will collect the levy through existing PAYE payroll and Self Assessment

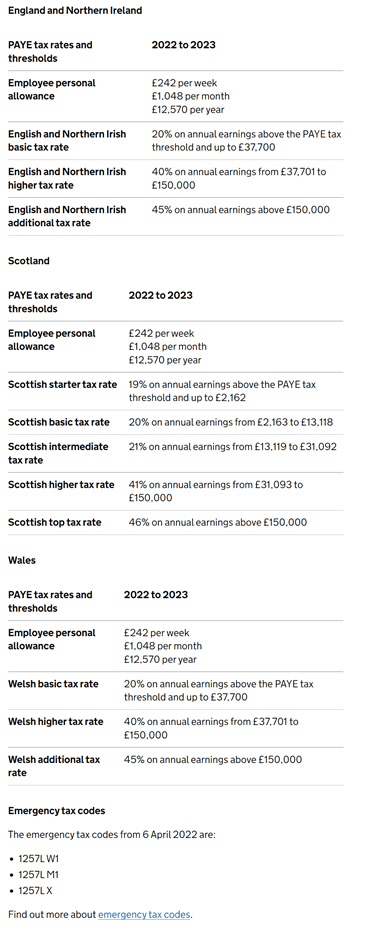

Statutory Increases

Statutory Maternity, paternity, sick pay etc have all increased. For a comprehensive guide on these please visit the link below:

Rates and thresholds for employers 2022 to 2023 - GOV.UK (www.gov.uk)

Gender Pay Gap Reporting

You must report your gender pay gap data if your organisation has 250 or more employees on a specific date. Last year this date was extended due to the impact of the Covid 19 Pandemic however this year’s deadlines are set as follows:

· 30 March 2022 – this is for most public authority employers

· 4 April 2022 – this is for private, voluntary and all other public authority employers

Details of what you need to report can be found here:

Report your gender pay gap data - GOV.UK (www.gov.uk)

Pay Fairness and Pay Reporting

Following questions around fairness practices in organisations, the UK has now introduced various regulations. For example, it is now a law to treat employees fairly in various areas such as policy and practice, and reward management. It is also a legal requirement for large employers to disclose pay data.

For more information visit: https://www.cipd.co.uk/knowledge/strategy/reward/pay-fairness-reporting-factsheet

The Employment Bill & Further Law Developments for 2022

Luke at Menzies Law has written a roundup of the planned changes in employment law coming in 2022. You can read more here: https://www.menzieslaw.co.uk/blog-2022-employment-law-developments/

If you would like any clarification on the above please contact us Book a free consultation | Reward Risk